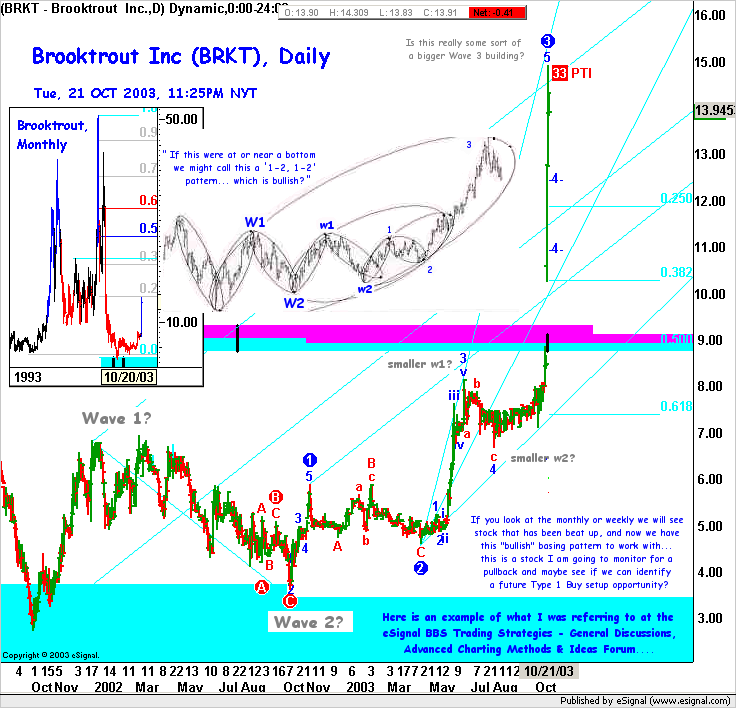

This chart is a quick look as a result of a question; see chart for question...

Announcement

Collapse

No announcement yet.

Interesting Chart Patterns To Monitor In Coming Days...

Collapse

X

-

Just a quick look at a simple cross referencing example. Here we see some sort of a weekly NWAC wave 3 labeled in progress. The daily is showing a series of higher highs and lower lows... it is unclear yet how all this is going to ultimately work out, but for now I continue to monitor for proper risk/reward opportunities. If it truly is a bigger Wave 3 building... wondering outloud what the potential really could be???? Let's monitor and see how all this evolves. (Under certain conditions my best guess is 3 to 6 months, or sooner, odds favor we see this stock higher.)

Marc

Marc

Comment

-

Nikkei update, xtl illustration

Here is an update of a previous Japanese Nikkei work done last May 2003.

To review a more detailed previously posted 14 May monthly and weekly Nikkei, click here.

Marc

Marc

Comment

-

This is a stock found in the eSignal Power Scan.... I took a look at this stock after finding it in the scan, then looking at news to identify reasons for its strength. The news said something about, " OmniVision Raises 2nd-Quarter Outlook." The stock continues to hold up strong today. While my job is not to trade for others, I do find identifying stronger chart movements safer to show others because they typically indicate some form of a Wave 3 in action, and they tend to often have follow-though ability later on. This fits with Elliott Wave theory. So, I tend to like to point these general types of patterns in advance so astute traders may benefit some way shape or form. Below is a current OVTI hourly chart.... you may notice, I prefer pullbacks as they provide safer entries and better risk/rewards. I have tried to give you some ideas which areas may have a stronger 'focal points.' How it would trade into a focal point would better determine its value, if any, later on.

Marc

Marc

Comment

Comment