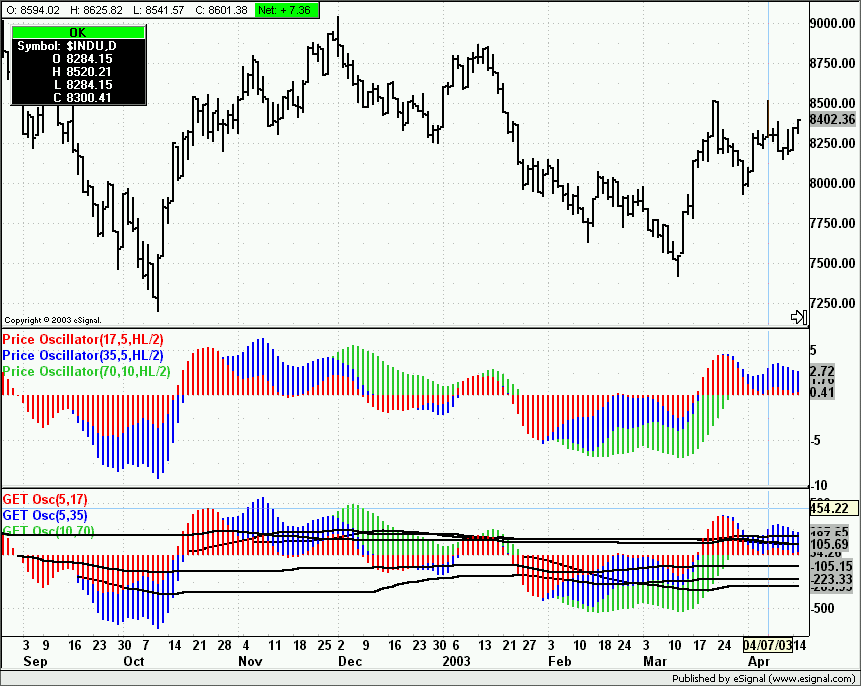

According to Tom Josephs, Wave 4's 5,35 OSC cannot exceed 140% retracement on a Daily Chart. However, does such an OSC "pullback" rule also apply to *intraday* Wave 4's?

For example, if you look at the 15-min intraday chart of $INDU (Dow Industrials) for today (Feb 18), you'll notice that the Wave 4 OSC has definitely exceeded the 140% OSC rule. However, PTI is still above 35 (is at 64), so I wonder if the impulse wave is still in place.....or, will waves 1-3 be relabled as ABC?

Thanks in advance!

For example, if you look at the 15-min intraday chart of $INDU (Dow Industrials) for today (Feb 18), you'll notice that the Wave 4 OSC has definitely exceeded the 140% OSC rule. However, PTI is still above 35 (is at 64), so I wonder if the impulse wave is still in place.....or, will waves 1-3 be relabled as ABC?

Thanks in advance!

Comment