Mark R. is doing a super job on this board. He is always keen to help and discuss ideas. In my opinion he is THE master trader and teacher with tremendous insights into markets. Read all of his posts, save them, and re-read them.

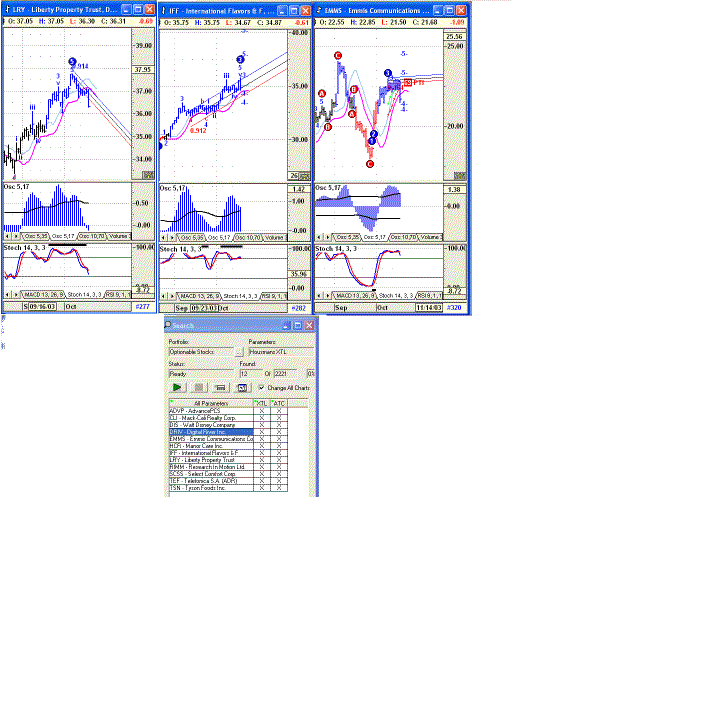

I found that continuation XTL trades are about the most reliable ones. The initial XTL signal usually does not have a good follow-through, and the market tends to return to its previous range quite often. The second XTL breakout is usually better, but I like to wait for a pullback after the second XTL breakout signal, in the form of XTL continuation trade, both up and down. The risk is easily defined and a reasonable initial profit target is adequately defined. For stocks I would go with the daily chart continuation XTL signal whereas for futures the 60min charts gives you some good clues. If time permits I will post some charts later. I use Adv GET EOD, latest version with Esignal wizard data.

Happy as a clam,

Philippe

I found that continuation XTL trades are about the most reliable ones. The initial XTL signal usually does not have a good follow-through, and the market tends to return to its previous range quite often. The second XTL breakout is usually better, but I like to wait for a pullback after the second XTL breakout signal, in the form of XTL continuation trade, both up and down. The risk is easily defined and a reasonable initial profit target is adequately defined. For stocks I would go with the daily chart continuation XTL signal whereas for futures the 60min charts gives you some good clues. If time permits I will post some charts later. I use Adv GET EOD, latest version with Esignal wizard data.

Happy as a clam,

Philippe

Comment