Dean

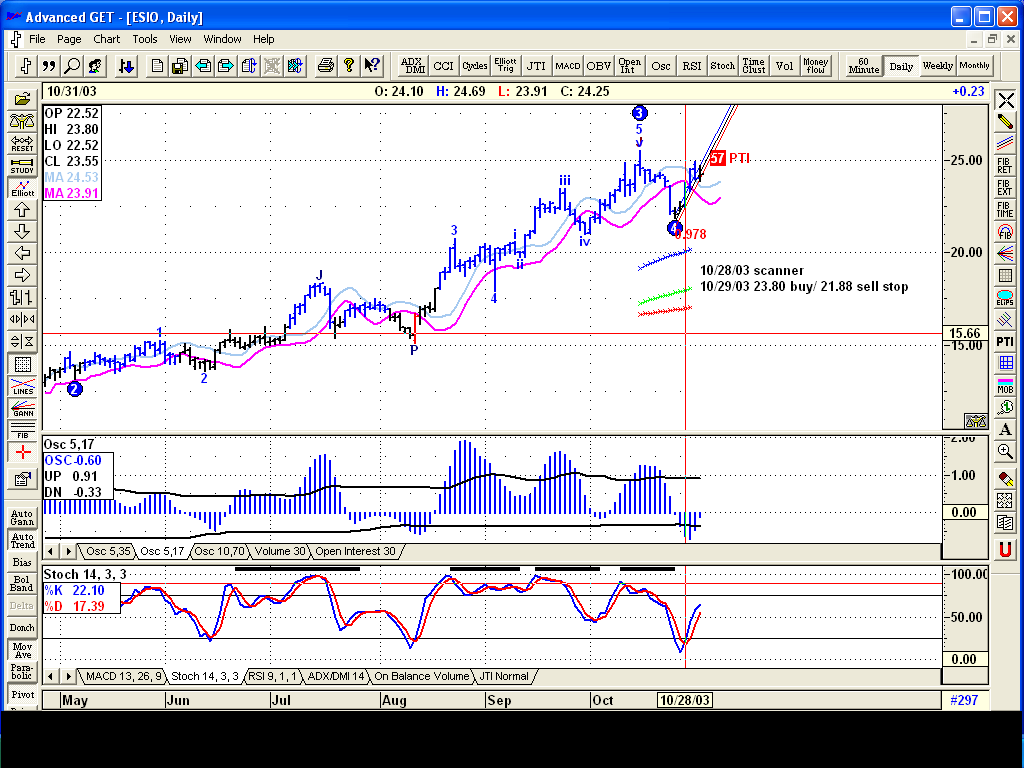

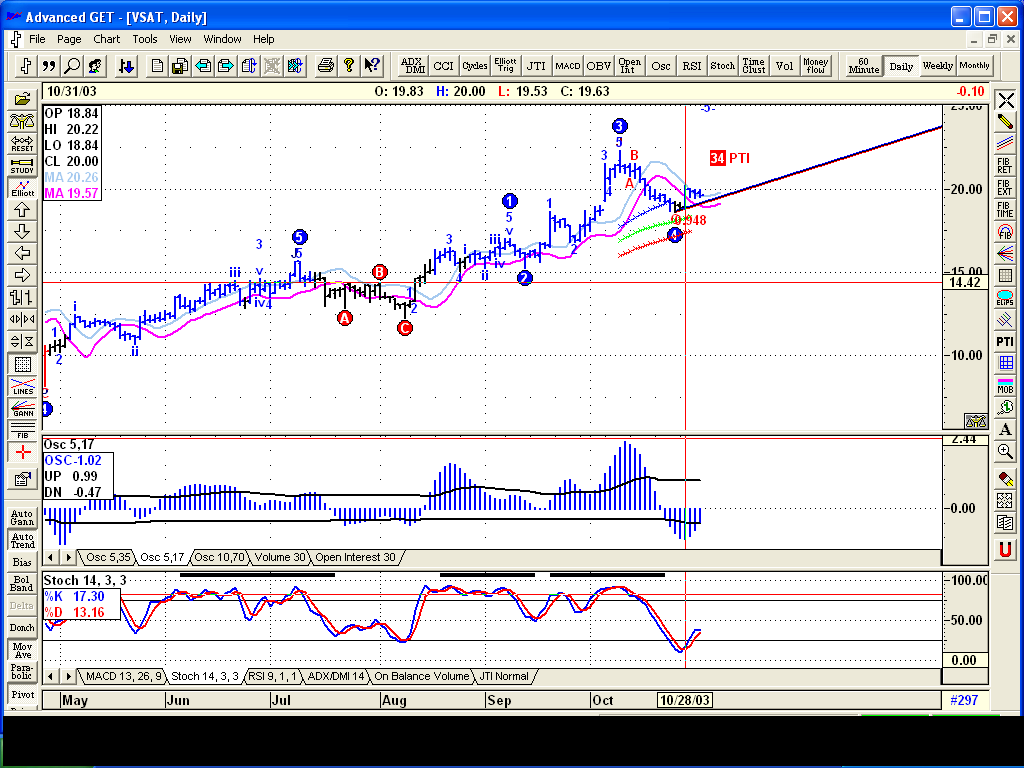

Very interesting comparison. What do you conclude which stochastics and oscillator pullback is best?

Regarding wave 5: it is more comfortable taking a hitch on a wave 3 than on a wave 5, although some wave 5's turn into 3's over time. Oscillator divergence on adjacent time frames would be a tipoff though.

Harndog, Thank you for the suggestion. Will take a look at that.

prh

Very interesting comparison. What do you conclude which stochastics and oscillator pullback is best?

Regarding wave 5: it is more comfortable taking a hitch on a wave 3 than on a wave 5, although some wave 5's turn into 3's over time. Oscillator divergence on adjacent time frames would be a tipoff though.

Harndog, Thank you for the suggestion. Will take a look at that.

prh

Comment