You can use it anywhere you want.

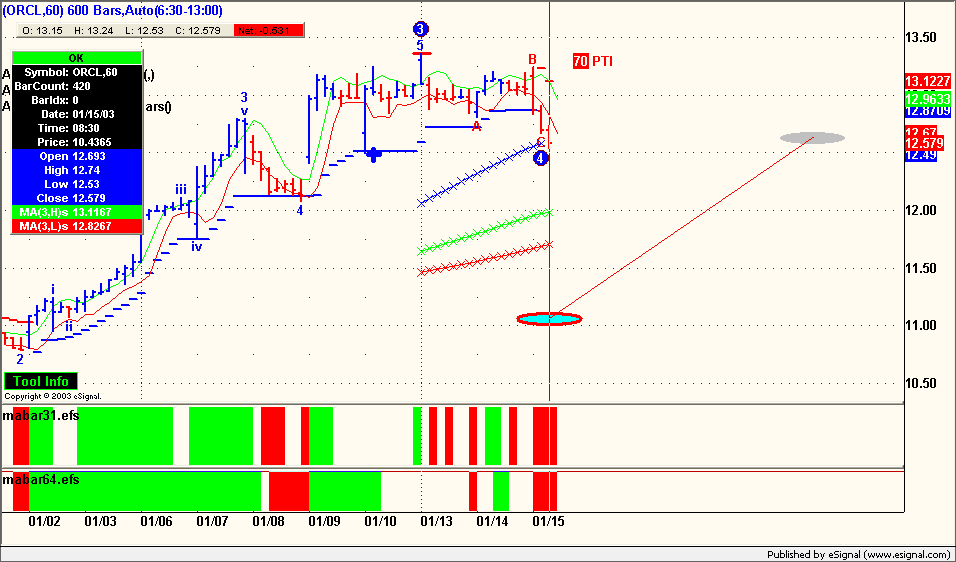

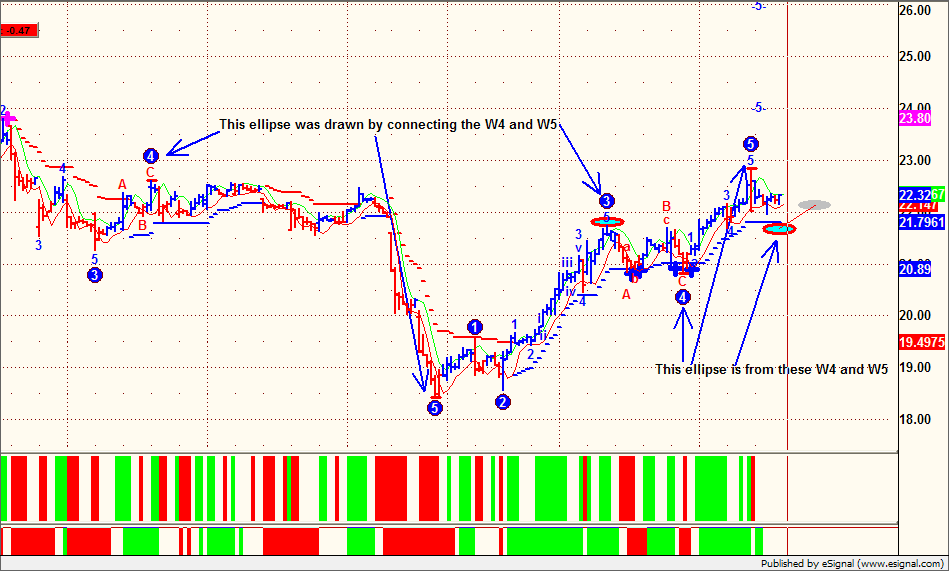

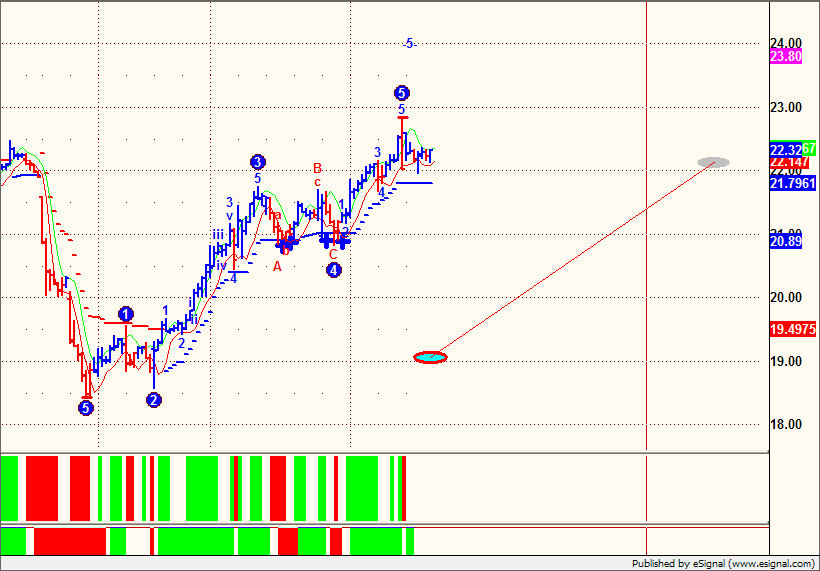

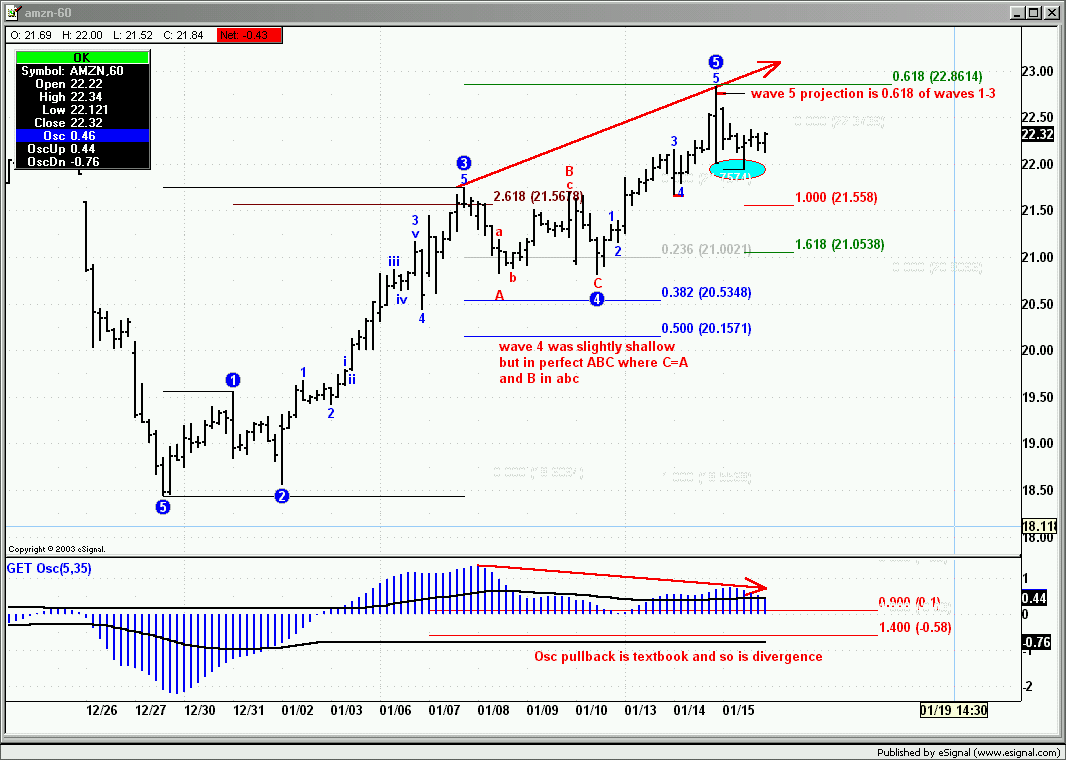

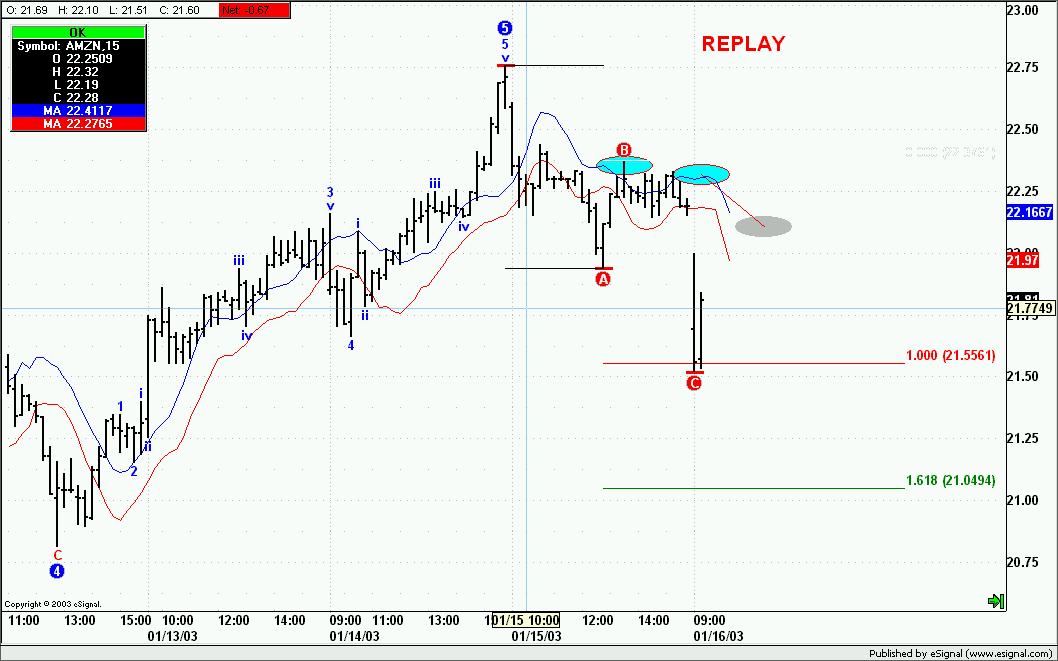

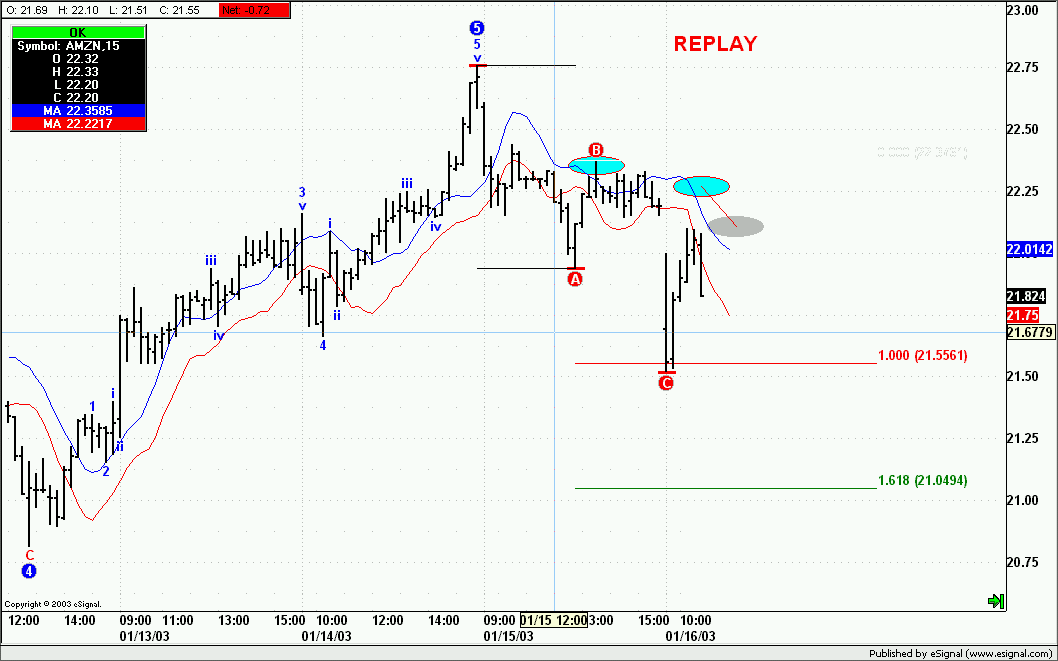

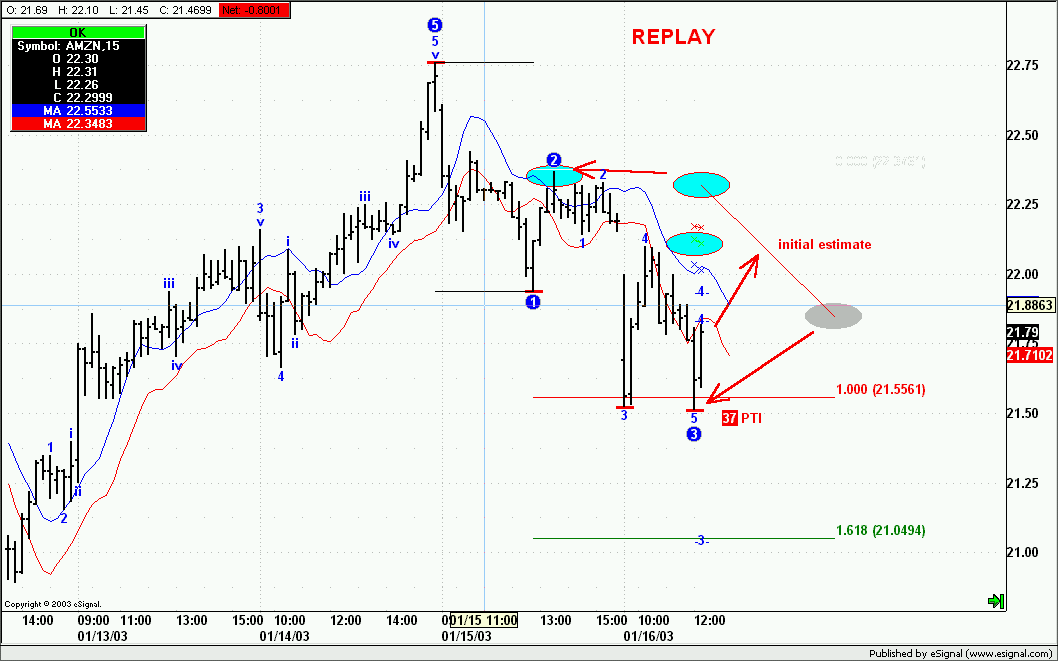

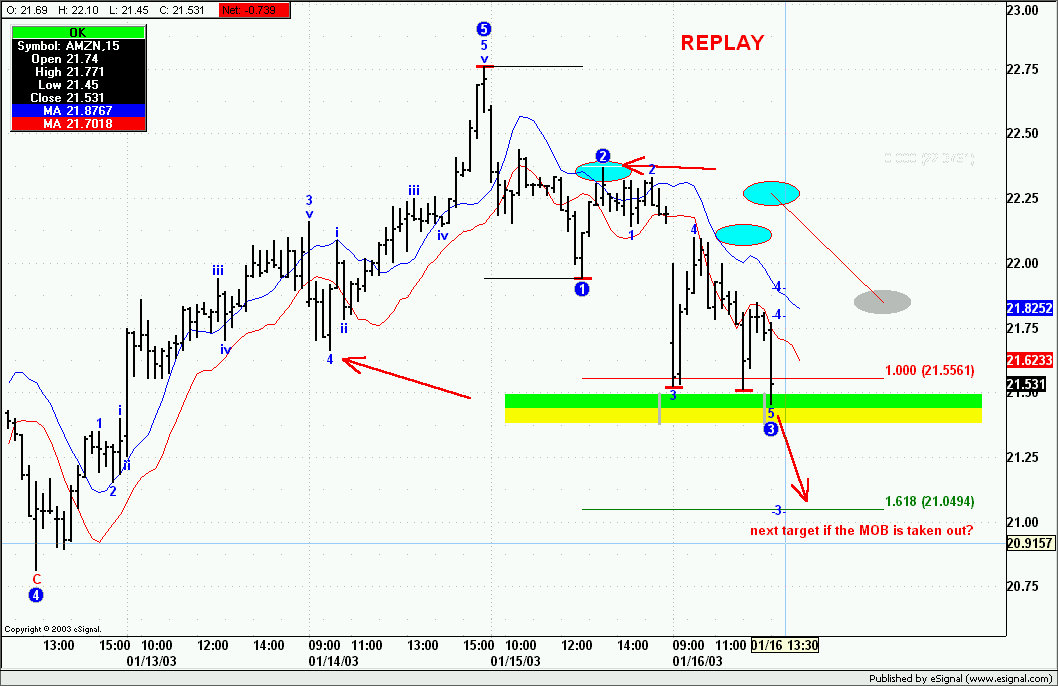

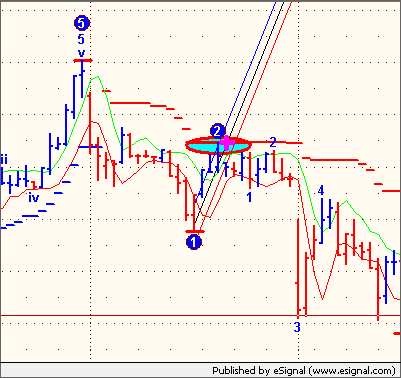

For example at the end of a B wave to enter what is initially a C and which could then evolve into a 3.

Or you can use it as a protective stop for an existing trade.

The basic principle is excellent risk/reward evaluation because you are measuring retracements against defined points of inflection while being able to define a projection.

The interesting thing is that it is an invaluable tool even when it fails because it provides signals for stop and reverse trades (will try to provide example a bit later using today's INTC set up)

Alex

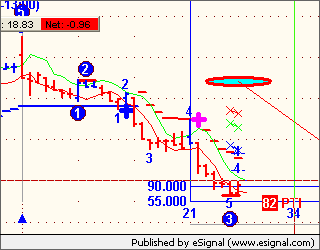

For example at the end of a B wave to enter what is initially a C and which could then evolve into a 3.

Or you can use it as a protective stop for an existing trade.

The basic principle is excellent risk/reward evaluation because you are measuring retracements against defined points of inflection while being able to define a projection.

The interesting thing is that it is an invaluable tool even when it fails because it provides signals for stop and reverse trades (will try to provide example a bit later using today's INTC set up)

Alex

Comment