Another Ellipse Idea

Hi Matt, Alex!

Have you ever been day-trading on very short-term charts-- such as a 5 minute-- only to find yourself getting confused? I have.

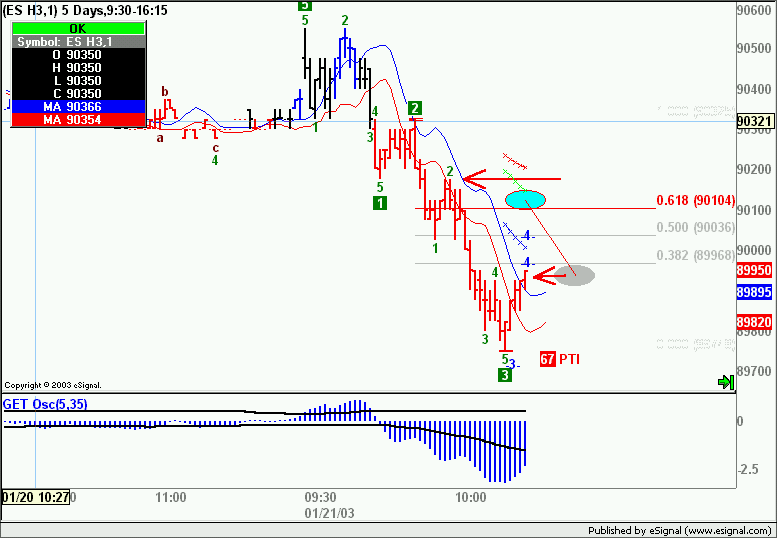

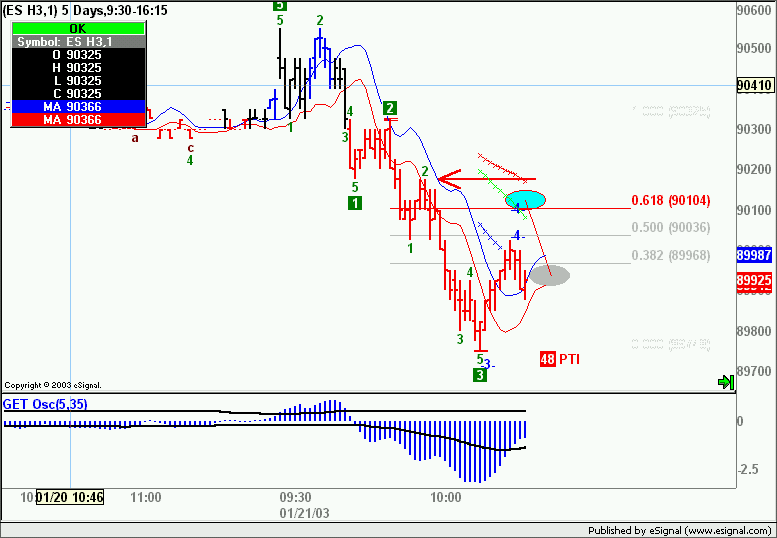

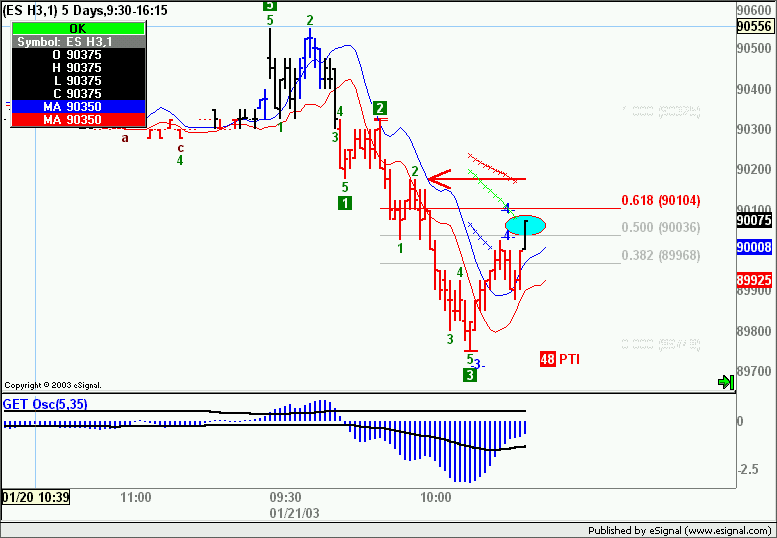

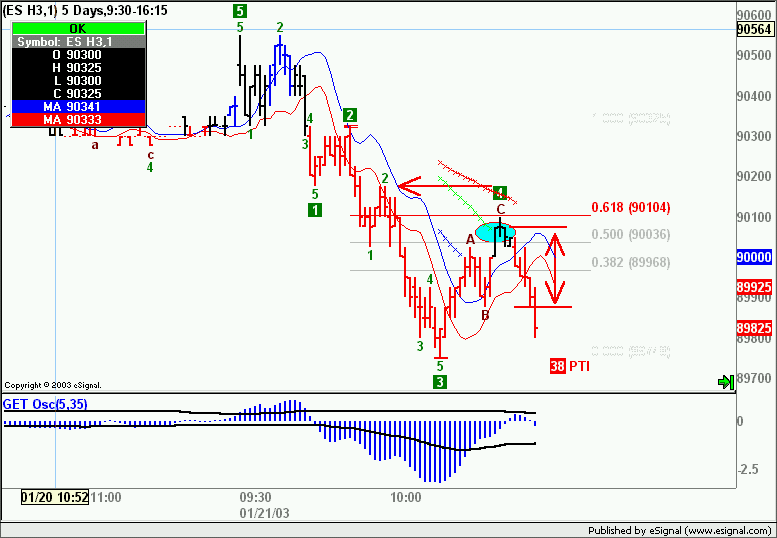

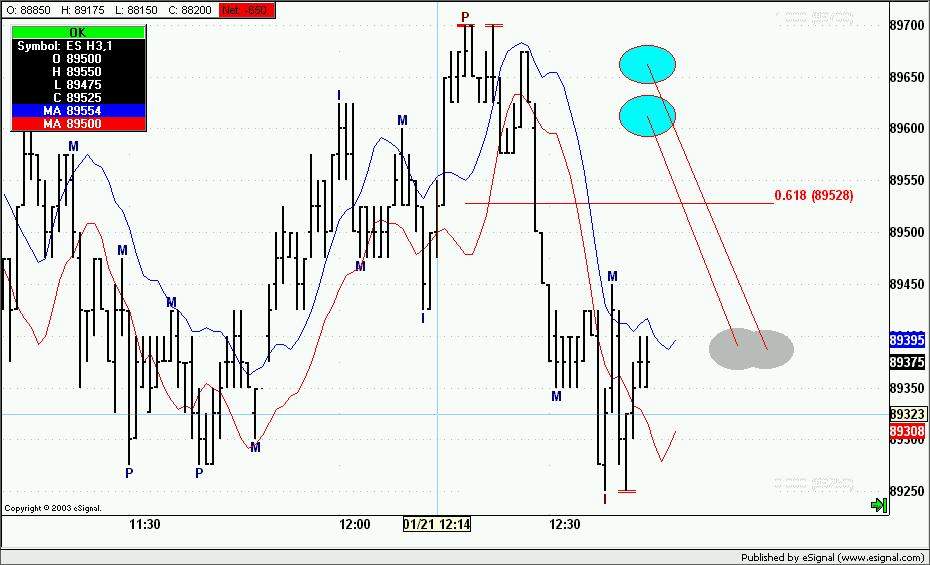

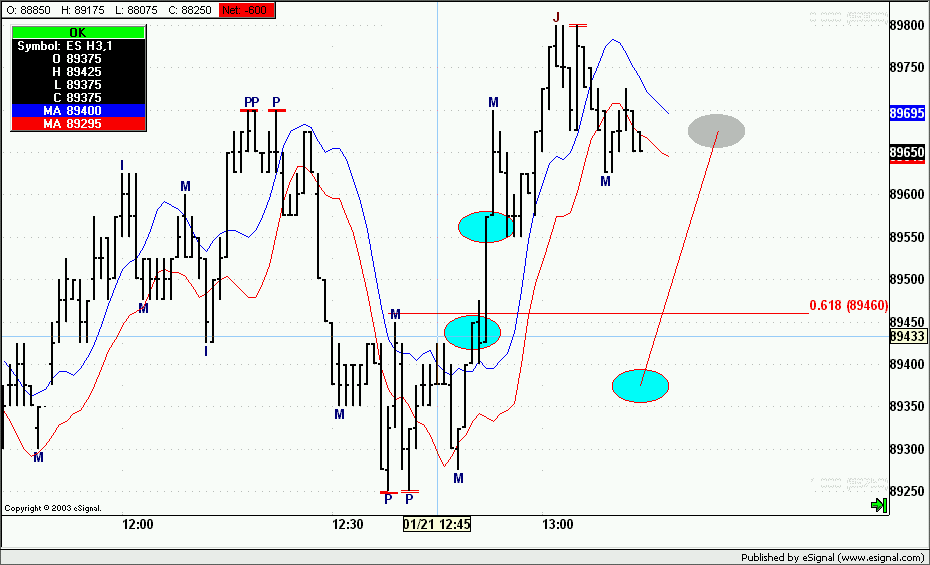

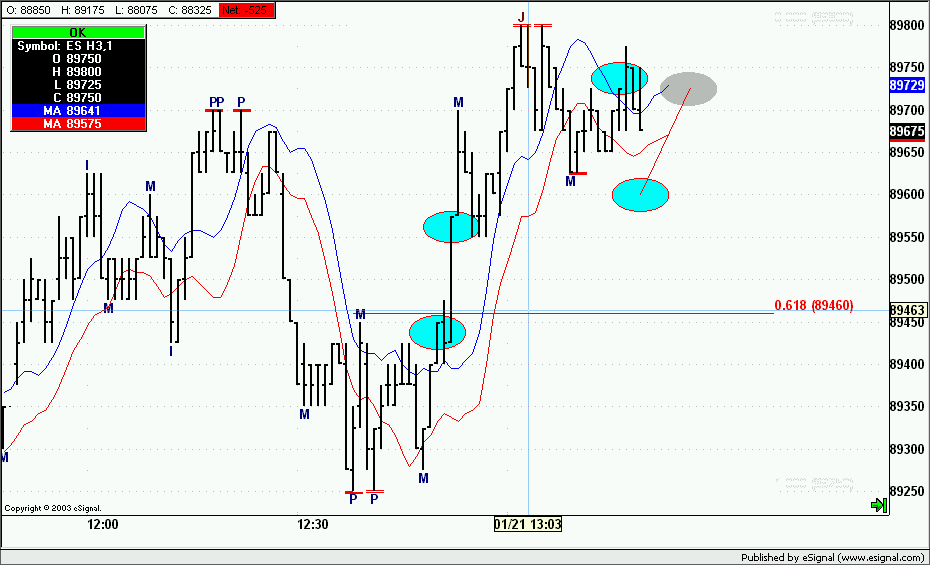

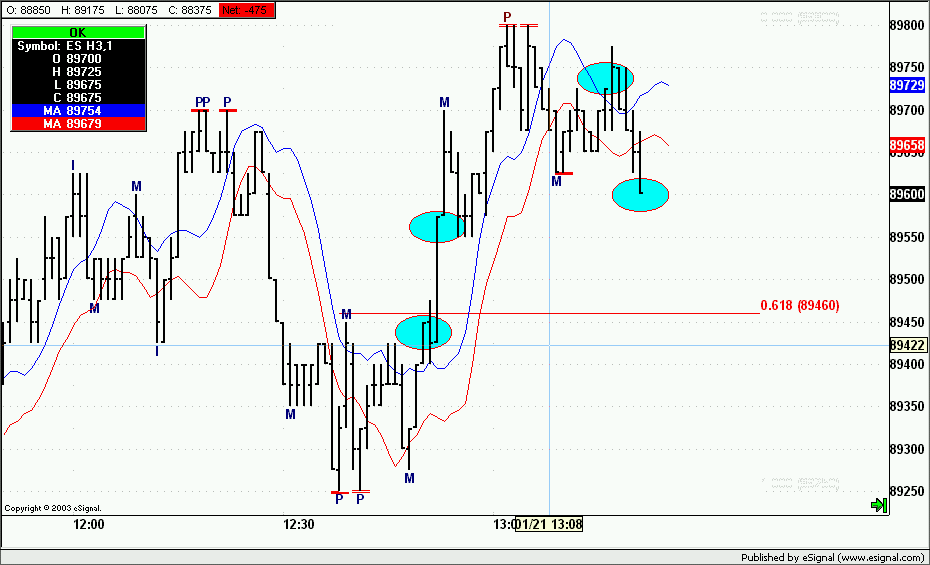

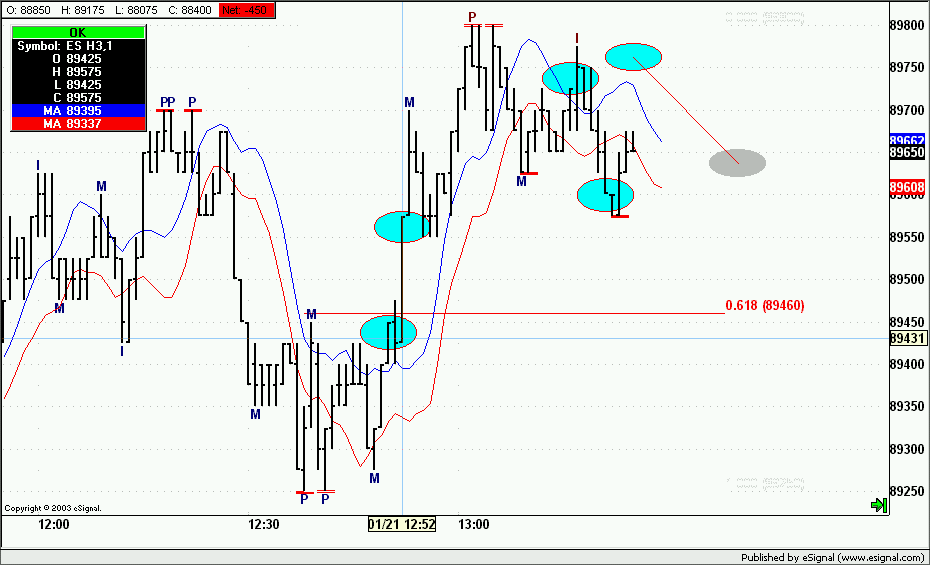

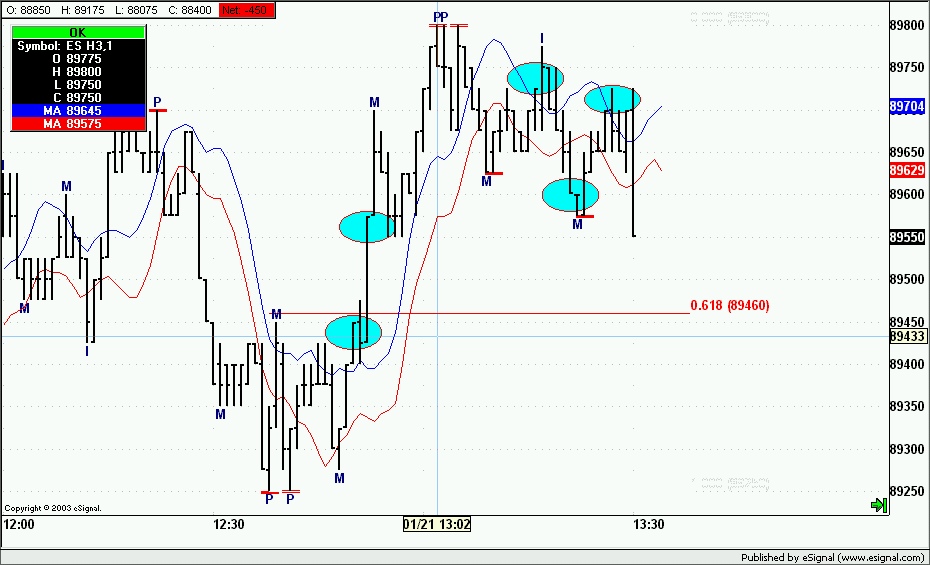

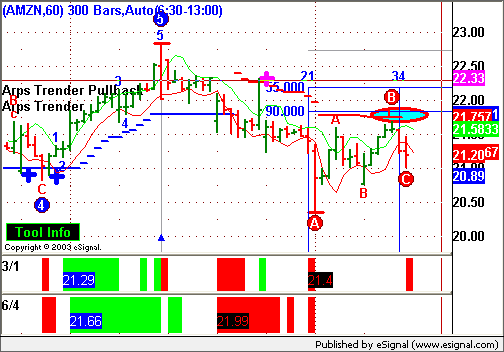

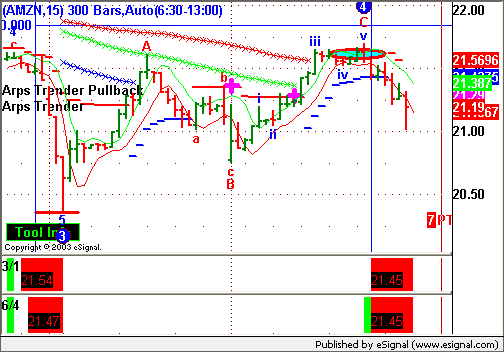

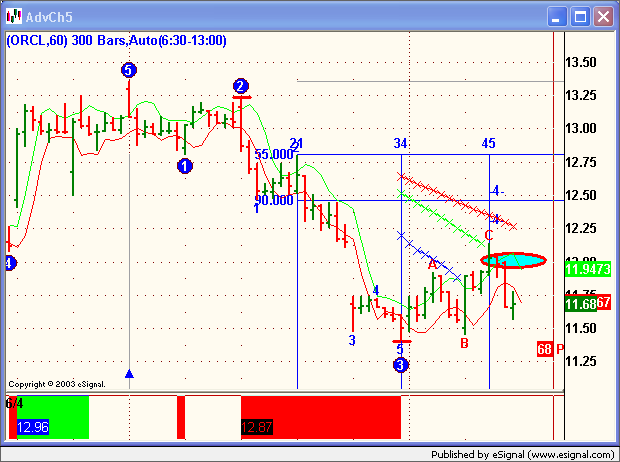

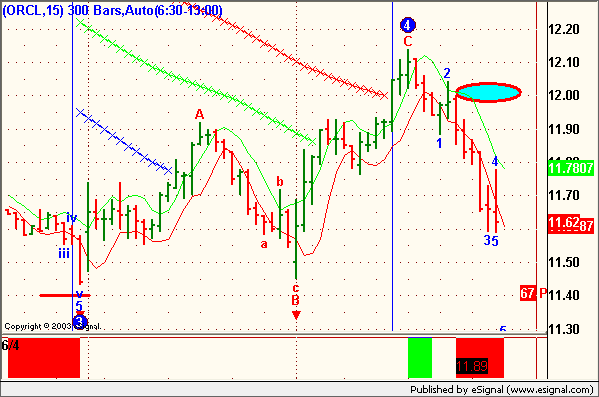

One technique I use to compensate for confusion is to focus on AGET primary pivots when applying Ellipse calculations.

I find TJ's Web and MOB's can, also, provide often additional day-trade support or resistance understanding.

Attached is an Amazon, 5 minute chart to illustrate a little better what I mean.

- Marc

P.S. I appreciate your conversations. It is good reading. Keep up the excellent work!

Hi Matt, Alex!

Have you ever been day-trading on very short-term charts-- such as a 5 minute-- only to find yourself getting confused? I have.

One technique I use to compensate for confusion is to focus on AGET primary pivots when applying Ellipse calculations.

I find TJ's Web and MOB's can, also, provide often additional day-trade support or resistance understanding.

Attached is an Amazon, 5 minute chart to illustrate a little better what I mean.

- Marc

P.S. I appreciate your conversations. It is good reading. Keep up the excellent work!

Comment