-----Original Message-----

To: Rinehart, Marc

Subject: AGET parabolic

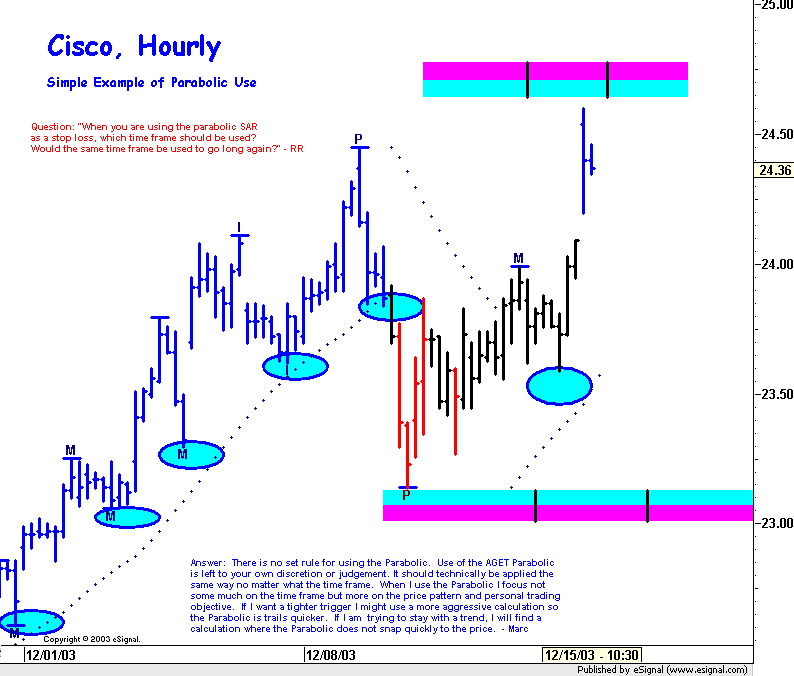

When you are using the parabolic SAR as a stop loss, which time frame should be used?

Would the same time frame be used to go long again? - RR

- - - - - - - - - - - - - - - - - - - - - - - - -

There is no set rule for using the Parabolic. Use of the AGET Parabolic is left to your own discretion or judgement.

It should technically be applied the same way no matter what the time frame.

When I use the Parabolic I focus not some much on the time frame but more on the price pattern and personal trading

objective. If I want a tighter trigger I might use a more aggressive calculation so the Parabolic is trails quicker. If I am

trying to stay with a trend, I will find a calculation where the Parabolic does not snap quickly to the price.

To: Rinehart, Marc

Subject: AGET parabolic

When you are using the parabolic SAR as a stop loss, which time frame should be used?

Would the same time frame be used to go long again? - RR

- - - - - - - - - - - - - - - - - - - - - - - - -

There is no set rule for using the Parabolic. Use of the AGET Parabolic is left to your own discretion or judgement.

It should technically be applied the same way no matter what the time frame.

When I use the Parabolic I focus not some much on the time frame but more on the price pattern and personal trading

objective. If I want a tighter trigger I might use a more aggressive calculation so the Parabolic is trails quicker. If I am

trying to stay with a trend, I will find a calculation where the Parabolic does not snap quickly to the price.

Comment