So, that's it?

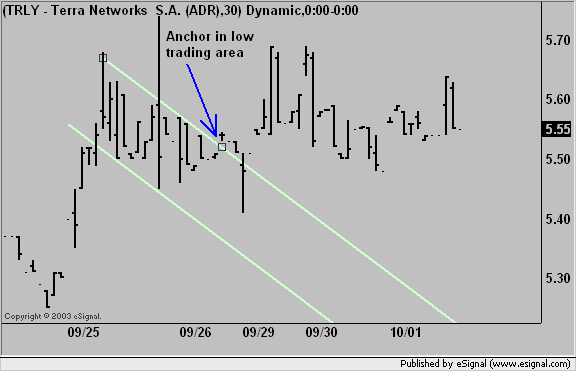

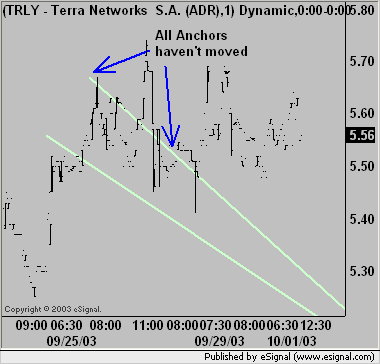

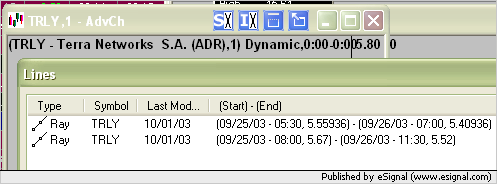

Well, I guess we just live with a software program that can't do trend lines in alternate time frames then, correct?

Has anyone at Esignal done any further research into this issue yet?

Can anyone tell me at least if you have put together a list of graphics cards that do indeed work with the software, or do we just hope that most people don't use trendlines in their trading?

I expect some follow-up either here or a personal email from a representative of the company. You don't have difficulty charging me each month for the service, at least you can touch base and let me know what the status of a known flaw (major flaw) is.

If it's my graphics card, that's fine, but I'd appreciate it if Esignal posted or notified users of known conflicts with cards, and compiled a list of cards that do not have issues. so that I can purchase one -- if indeed that is the difficulty.

It's not like trendlines are irrelevant to trading now is it?!

David Smith

Well, I guess we just live with a software program that can't do trend lines in alternate time frames then, correct?

Has anyone at Esignal done any further research into this issue yet?

Can anyone tell me at least if you have put together a list of graphics cards that do indeed work with the software, or do we just hope that most people don't use trendlines in their trading?

I expect some follow-up either here or a personal email from a representative of the company. You don't have difficulty charging me each month for the service, at least you can touch base and let me know what the status of a known flaw (major flaw) is.

If it's my graphics card, that's fine, but I'd appreciate it if Esignal posted or notified users of known conflicts with cards, and compiled a list of cards that do not have issues. so that I can purchase one -- if indeed that is the difficulty.

It's not like trendlines are irrelevant to trading now is it?!

David Smith

Comment