Re: Some simple tools

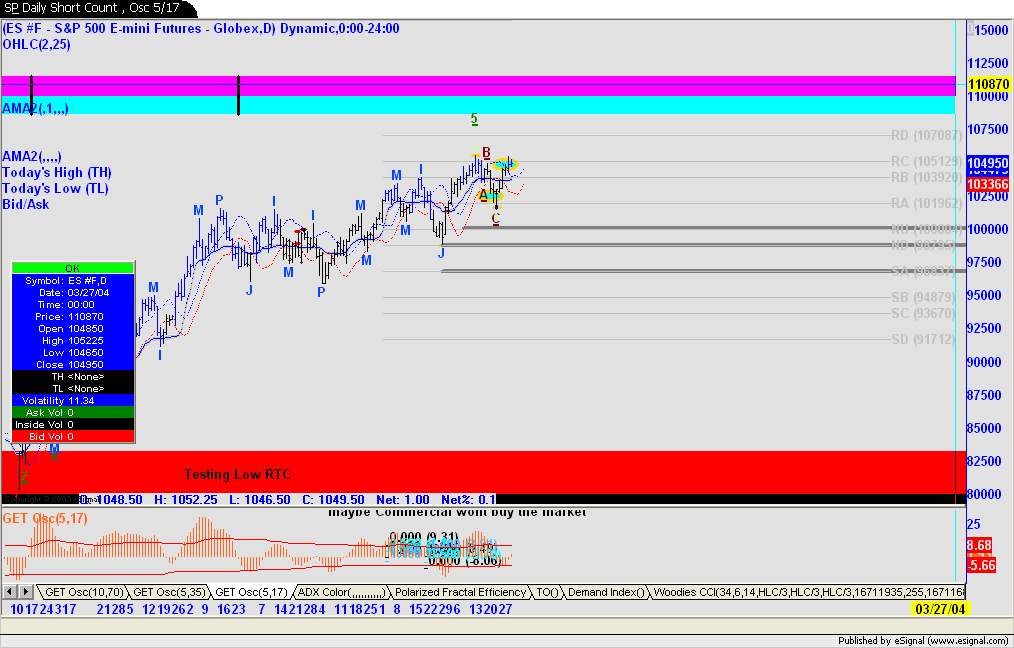

Me like Linus. I have 1093 by Dec 11

Me like Linus. I have 1093 by Dec 11

Originally posted by linus71

Jeff, I like your merged MACDs.

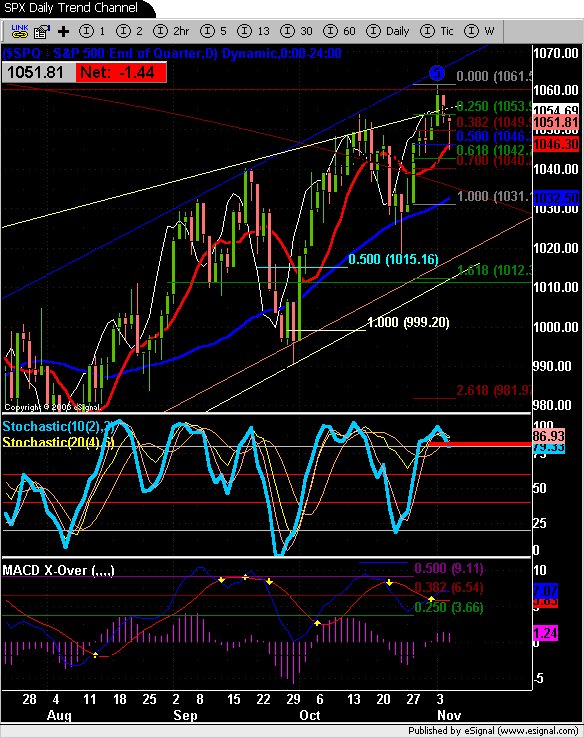

I found this weekly chart of the SPX very interesting:

I used the 10 week and 50 week SMAs,

a regression trend channel drawn from March 2000 to the low of November 2002,

a Fib extension,

and a MACD without much consideration....

What I find noticeable is how the prices go along the Fibonacci circle line.

Maybe the uptrend can last until 1094 points in January 2004?

Linus

-------

Jeff, I like your merged MACDs.

I found this weekly chart of the SPX very interesting:

I used the 10 week and 50 week SMAs,

a regression trend channel drawn from March 2000 to the low of November 2002,

a Fib extension,

and a MACD without much consideration....

What I find noticeable is how the prices go along the Fibonacci circle line.

Maybe the uptrend can last until 1094 points in January 2004?

Linus

-------

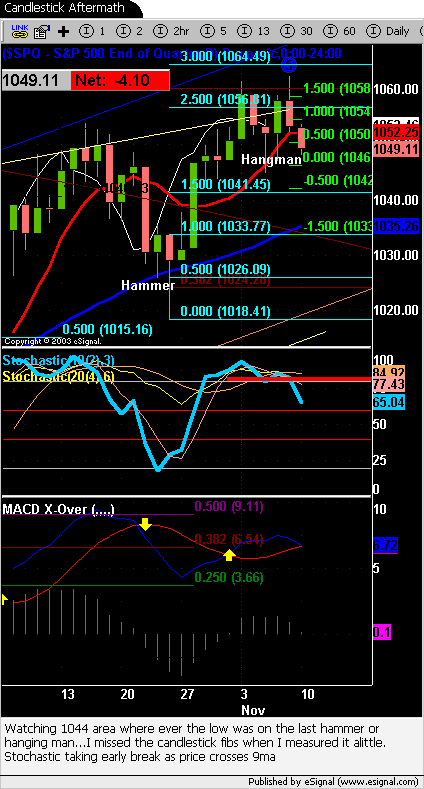

Comment