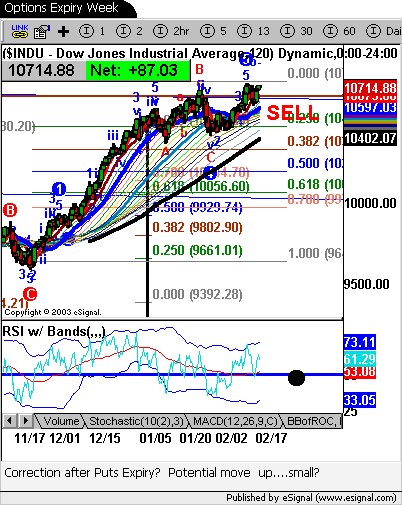

Index watching

The NAS is in a difficult spot. I am watching

the 9ma approach the 40ma on this daily

chart and notice it's rather steep.

It appears momentum can take us to a test of 1900

...look for signs of strength. Maybe intraday recovery?

The NAS is in a difficult spot. I am watching

the 9ma approach the 40ma on this daily

chart and notice it's rather steep.

It appears momentum can take us to a test of 1900

...look for signs of strength. Maybe intraday recovery?

Comment