Announcement

Collapse

No announcement yet.

Advanced Charting Methods & Ideas

Collapse

X

-

Comparison Analysis & Expectations

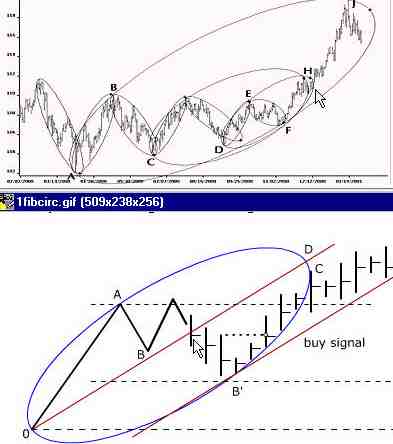

Great chart Fabrizio! Here's another perspective using jeffvision <g>

I also welcome Marc and all others to the forum, all comments

and contributions appreciated for the insight and experience they

come with. Thankyou in advance.

Sorry, for the clutter.....I had to add the Gann circles.....I don't

have squares or triangles<g> yet? BTW, I'm making comparison

observations on the years, 1998, 1999,2002, 2003, 2004<g>

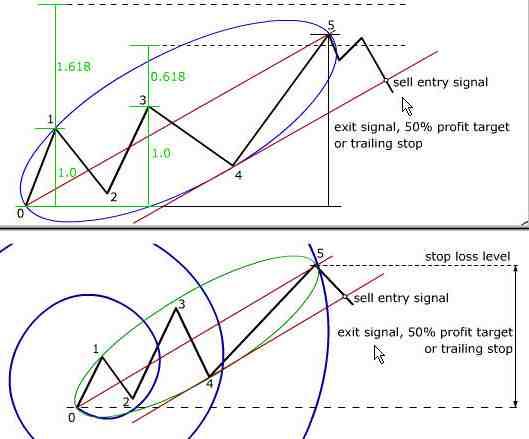

Leonardo Fibonacci was a 12th century mathematician who was believed to have discovered a

naturally recurring ratio in sequences of numbers. The Fibonacci "Golden Ratio" of .618 continually shows

up in both nature and the markets. WD Gann was probably the first trader to use Fibonacci

retracements and the Fib ratios of .382, .50 and .618 are very close to the Gann numbers of 3/8, 4/8 and 5/8,

which Gann used over and over in his chart calculations. Retracements are calculated from recent significant

price highs and lows or pivot points. The ratios that appear most frequently in the stock and futures

markets are .382, .50, .618, .786, 1.00, 1.272 and 1.618 and are used for both price and time analysis.

Good Trading,

~j

Last edited by JJordan; 10-02-2003, 06:07 AM.

Comment

-

Comment

-

Line Studies

Originally posted by MarcRinehart

Jeff, Fabrizio:

Forgive me for being ornery today... but here is my Gann!

... you just have to look beyond the chaos for some meaning.

LOL, Love it! I've been trying to find a kaos background image

for my charts.....that's a fine wallpaper you picked!<g>

Line Studies Line studies are technical analysis tools

that consist of lines drawn on top of a security's price and/or indicator.

These include the support, resistance, and trendline concepts already discussed.

BTW, Try not to put all the line studies on one chart!<g>

Good Job though.....keep pushing the envelope, those that

can see thru the chaos survive for another day. God Bless the adventurer.

~JLast edited by JJordan; 10-02-2003, 10:42 AM.

Comment

-

If, as Paul Harvey would say, "you want to see the rest of the story...." visit the AGET Gold thread later today when I post another weekly Gold chart showing how to make all that Gann angle information more meaningful. (click here to review that link)

PS - Fabrizio, under the Ellipse, by Wave 4... Waldo is shy... Marc

Marc

Comment

-

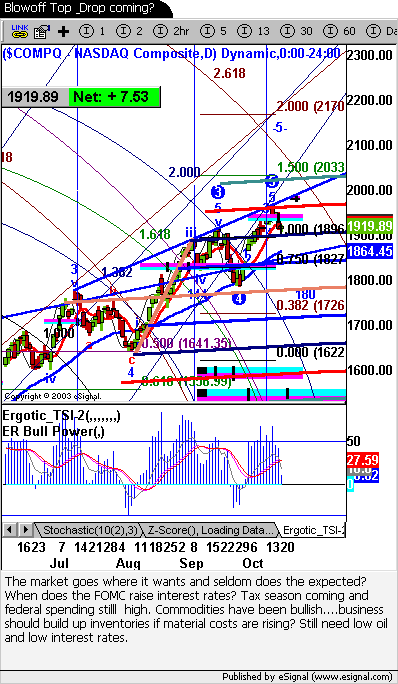

Anxious Market....if not, should be?

We are truly living in interesting times. Risks are increasing

IMO as big banks and bankers and governments speculate on the future.

Caution is a must when interpreting world economics.

Financial speculation and phoney economic growth isn't REAL GROWTH!

Real wealth comes from savings and investments and the production of real goods.

It doesn’t come from financial speculation. Printing money and expanding leveraged financial

assets that trade the markets is paper wealth—not real wealth.

Selling our assets to foriegn producers isn't growth! Consumption and debt growth isn't the answer!

Last weeks amazing reversal.

Speculation and greed in the hands of a few is dangerous.

Citigroup was the top net earner in 2002.( A very bad year for the market)

Japan and China are investing in our assets while paying higher interest rates on their own debt?

IMO, a sudden rise in interest rate or drop in the Dollar is not

good for our economy. The risks from imbalances.....Last edited by JJordan; 10-06-2003, 08:39 AM.

Comment

-

-

Re: Mountains, Peaks and Valleys - All must be overcome

Originally posted by JJordan

Do it right or do it wrong, it's all right......

Looking for market opportunities is like looking for patience.

Some call it timing some call it faith, others gambling?

Comment

-

Eclipses, circles and fibonacci ideas, con't.

Originally posted by linus71

my suggestion for the future is the Composite could rise

further moving within its trend channel (Chart is Nasdaq)

Linus

A good chart and analysis previously posted by Linus:

Now if we had an elliptical circle tool. (ovals, triangles & squares)

.....we could play with fibonacci

some more...

Last edited by JJordan; 10-22-2003, 10:30 AM.

Comment

-

Trend channel con't.

the Composite could rise

further moving within its trend channel (Chart is Nasdaq)

I didn't intend to publish this chart(not very clean), but find the pattern

worth studying as the trend seeks it's conclusion. The

questions some will ask is; Have we seen the highs....or

continue toward 50% year? Watch your trend channeeel!

~j

Comment

Comment