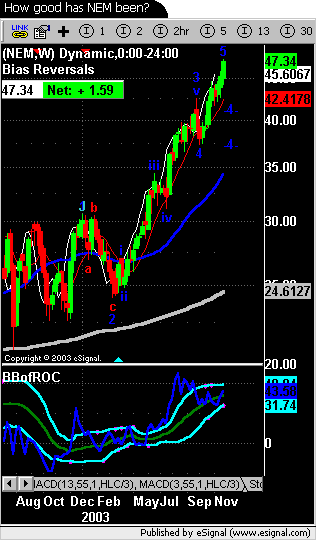

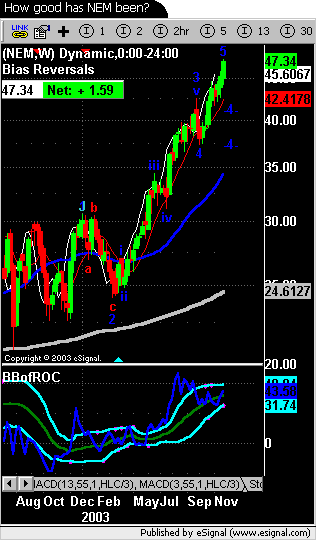

Charts of Interest looking at ROC different paces

Looking at things in similar ways gives depth to methods.

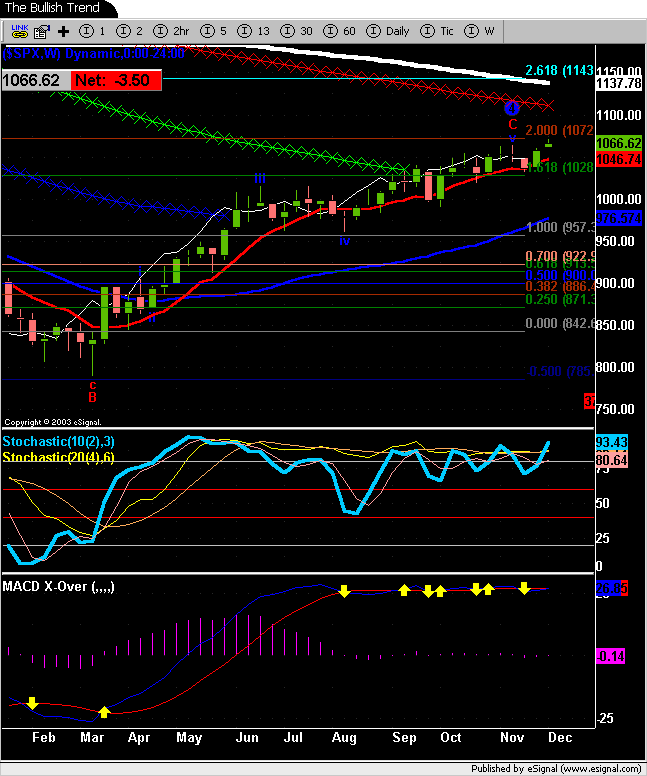

The e-mini futures on open.....using 2 minute trading

Looking at things in similar ways gives depth to methods.

The e-mini futures on open.....using 2 minute trading

Comment