INTC EW Analysis

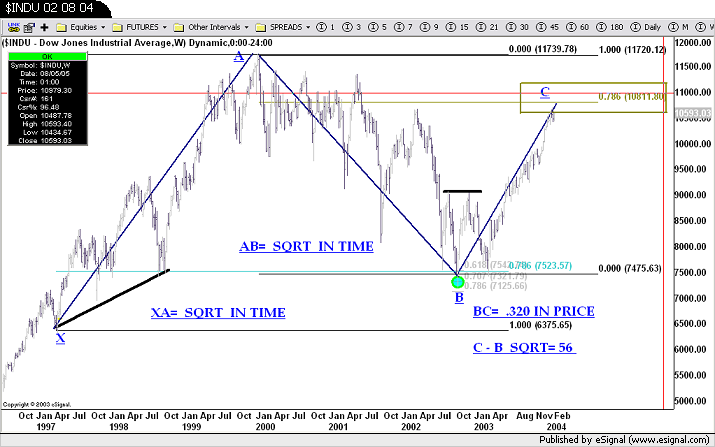

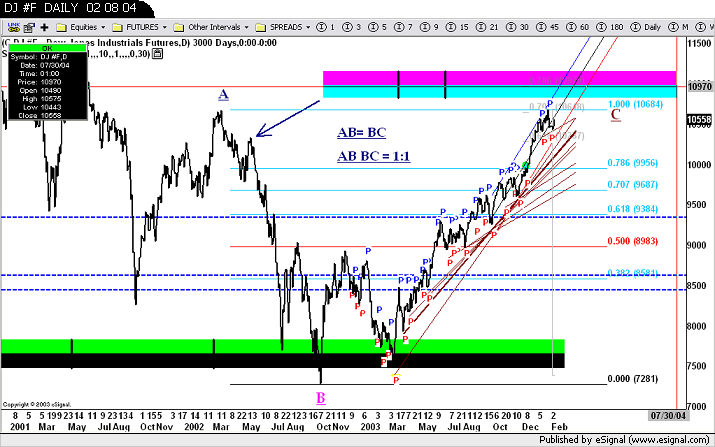

Impulse patterns are not the most commonn Elliott structures. Corrective patterns are. Impulses are part of the corrective structure. Think in terms of Flats, Zig-Zags, Diagonals -- particularly because we are trading in the context of a correction off the 2000 highs.

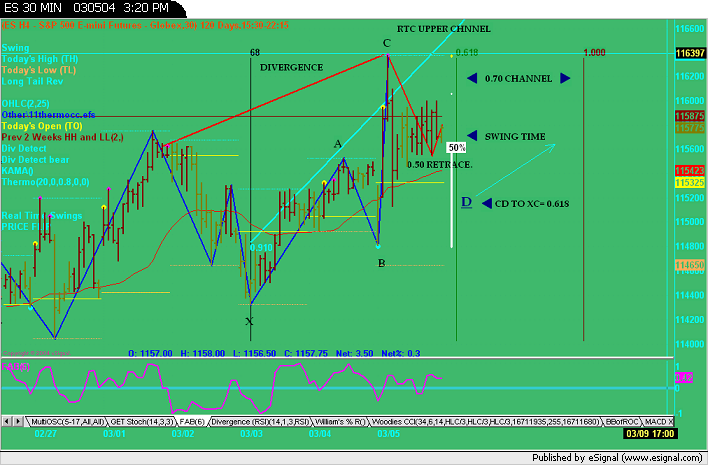

So, first, without going into a lot of detail. Start from the last major low.

This is what you get: a Flat with a completed A Wave. B down is ongoing.

Next, I'll take a closer look at that B Wave.

Impulse patterns are not the most commonn Elliott structures. Corrective patterns are. Impulses are part of the corrective structure. Think in terms of Flats, Zig-Zags, Diagonals -- particularly because we are trading in the context of a correction off the 2000 highs.

So, first, without going into a lot of detail. Start from the last major low.

This is what you get: a Flat with a completed A Wave. B down is ongoing.

Next, I'll take a closer look at that B Wave.

Comment