If you think the trend is still your friend, double check the long wave count (10/70) to see what it shows. It is less sensitive then the regular (5/35) and it can give you hope the trend will return once the internal 3-4-5 within a bigger W3 is completed?

Announcement

Collapse

No announcement yet.

Interesting Chart Patterns To Monitor In Coming Days...

Collapse

X

-

Hi,

UNM very similar to PSS pattern. I could see if UNM continues to hold between 16.94 and 16.35, eventually a nice move to next target 19.00 area. One idea: use the Normal Ellipse (from 10/19/04 to 12/31/05 pivots) as a possible guide? If it breaks below 16.35, it gets a little to hard to figure out what to do next.Originally posted by gelfont1

That is an interesting chart setup, do you see any others? How about UNM???Marc

Comment

-

Hi again!

Attracted to SIRI, again, and XMSR.Originally posted by gelfont1

That is an interesting chart setup, do you see any others? How about UNM???

I Bought some GR and TSCO yesterday for aggressive short-term trade ideas I liked. (Only wish I bought more of GR and less of TSCO cuz GR moving stronger today!)

Monitoring: BOOM, JOYG, VRSN, INTC, AMAT,and several energy and precious metal stocks for appropriate trade entries, if can find them.

More risky, low volume stocks with interesting patterns: daily WNI... wondering if it is a W3 not a W5? AXO cheap, curious if a W3 breakout? Same with CFK?

What's up with CHIR, besides today's price?

Does this help for today?

MarcMarc

Comment

-

I am pre-beta testing a new software product. PAAS daily came up yesterday as a buy at 16.54, stop loss at 15.95 and target at 17.93. Using eSignal's Advanced GET chart I was able to go into the hourly chart and figure out an aggressive Type 1 Buy setup. (see below attached PAAS hourly chart.) I am now monitoring for a pullback from yesterday's low to today's current breakout high to see if it sets up another aggressive buy.

MarcMarc

Comment

-

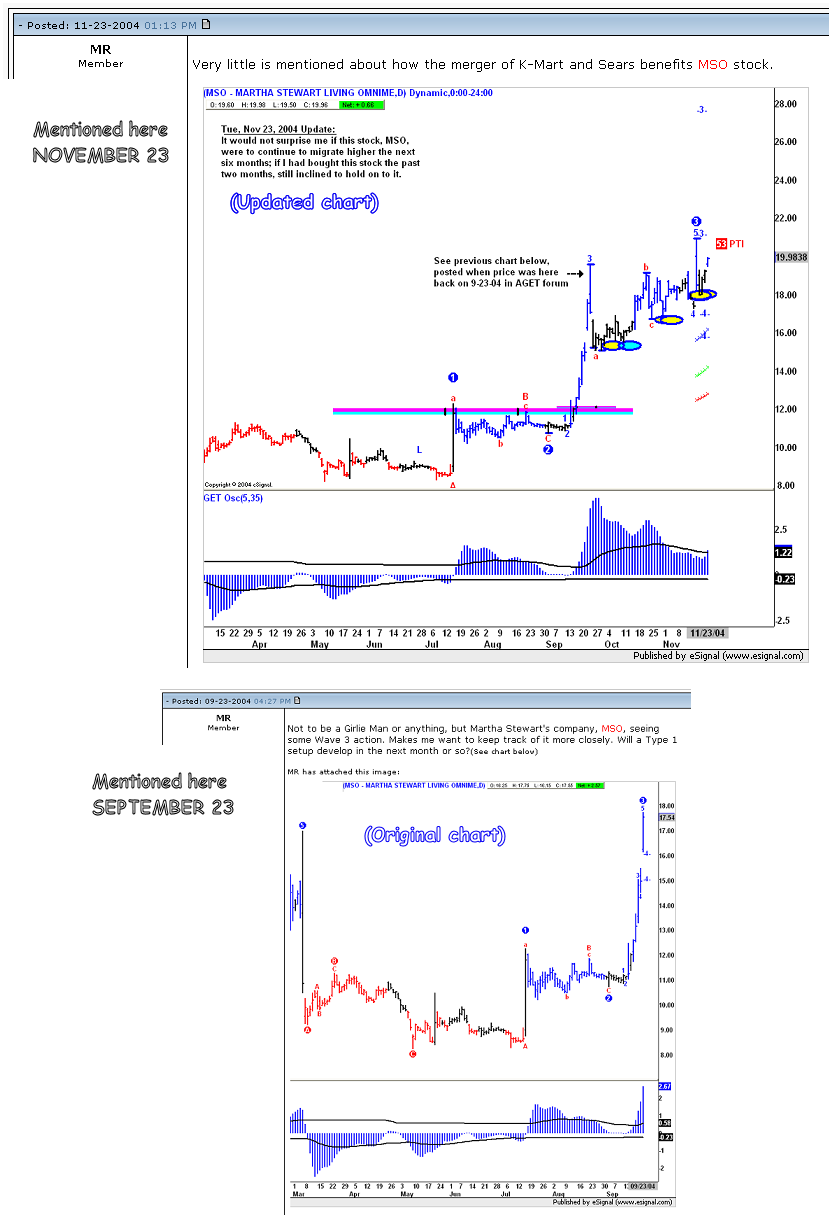

Martha Stewart (MSO), the stock.... update

Martha Stewart (MSO), the stock....

Many times last year I had very postive comments on Martha Stewart, Inc. (MSO) stock. In honor of Martha Stewart getting out of jail today, let's review a couple of the earlier posts. Last November I said, "It would not surprise me if this stock, MSO, were to continue to migrate higher the next six months; if I had bought this stock the past two months, still inclined to hold on to it." It was around $20 area then. Next post we shall see what MSO looks like today, March 4, 2005.

Marc

Marc

Comment

Comment