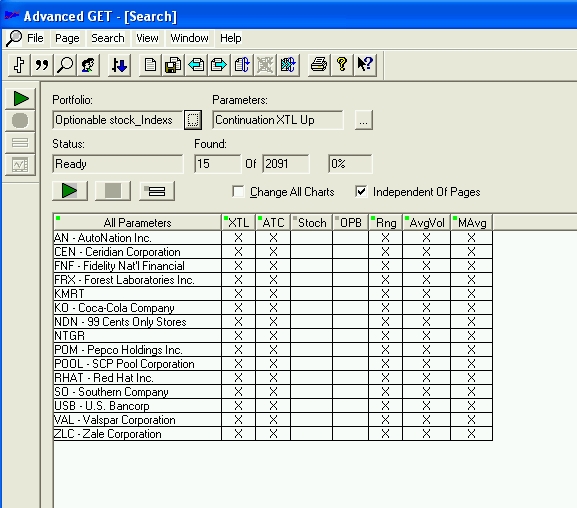

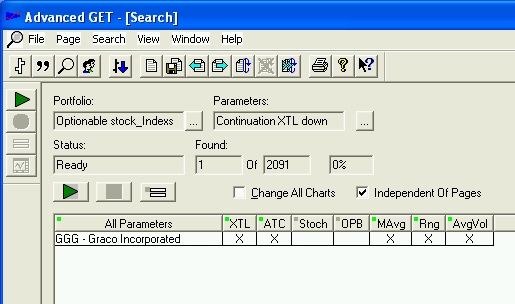

This excecise is by no means over.....But after several calls and conversations, the current version of AGET 7.7 does not readily support backdating scans and hence makes the process of backtesting far more tortuous than practical for those patience and time challenged traders.....

Plz consider adding this feature in future versions of AGET EOD, it would add considerable horsepower and utility to an already mean trading tool.

With this version of 7.7, backtesting this strategy is just going to take longer....Plz help us shorten this time with your contributions.

Kindest Regards, Dean

Plz consider adding this feature in future versions of AGET EOD, it would add considerable horsepower and utility to an already mean trading tool.

With this version of 7.7, backtesting this strategy is just going to take longer....Plz help us shorten this time with your contributions.

Kindest Regards, Dean

Comment