One other thing to consider...

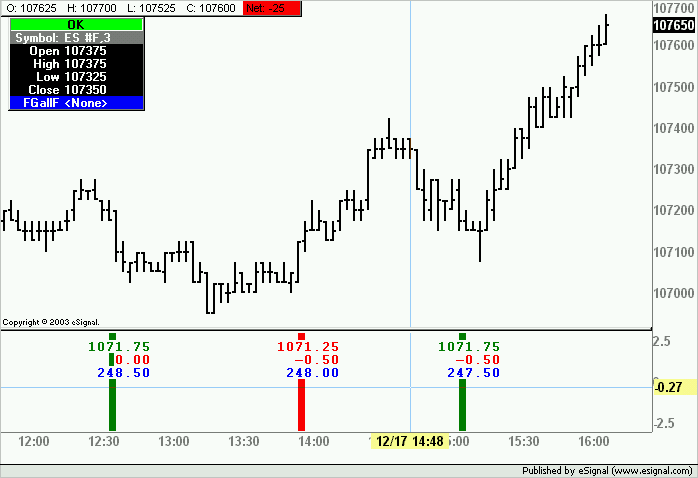

Take a look at the TRADES result for any one of the backtests...

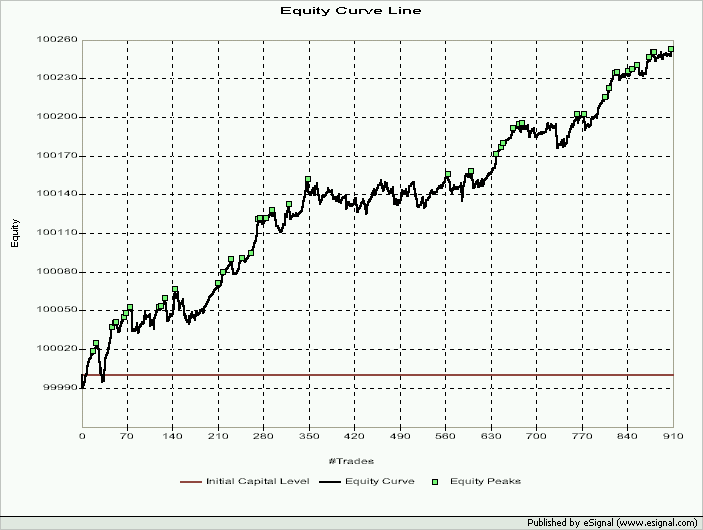

Has anyone noticed that a good portion of the LOSSES are caused by weekends. Nearly every single weekend results in a $400 to $1200+ LOSS.

I would have to assume that closing the trades on FRIDAY and opening back up for trading on Monday at 12AM (or whenever) might dramatically improve your trading results.

By a rough estimate (totaling up the trade results "in reverse" for all of the weekends in the following backtest report, the results were +$2037.50 added to the total.

Now, these results are probably inaccurate (as I'm simply eliminating trades that spanned the weekend). But this might be a key to better success.

Brad

Take a look at the TRADES result for any one of the backtests...

Has anyone noticed that a good portion of the LOSSES are caused by weekends. Nearly every single weekend results in a $400 to $1200+ LOSS.

I would have to assume that closing the trades on FRIDAY and opening back up for trading on Monday at 12AM (or whenever) might dramatically improve your trading results.

By a rough estimate (totaling up the trade results "in reverse" for all of the weekends in the following backtest report, the results were +$2037.50 added to the total.

Now, these results are probably inaccurate (as I'm simply eliminating trades that spanned the weekend). But this might be a key to better success.

Brad

Comment