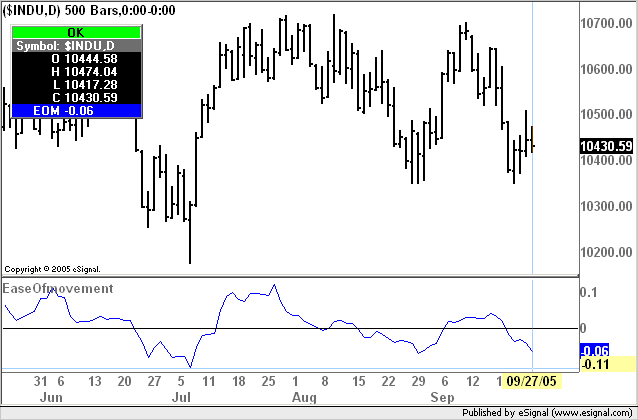

EaseOfMovement

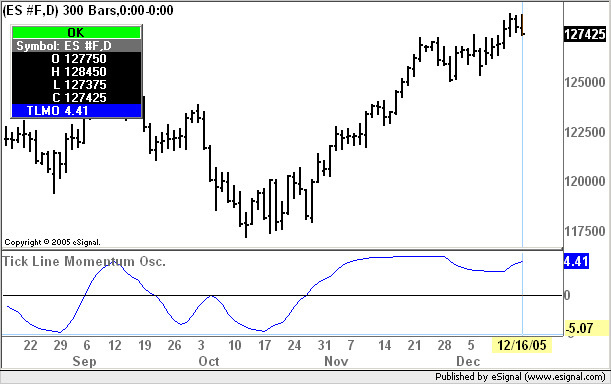

The attached efs computes the Arms Ease of Movement indicator using EFS2 syntax and is enabled for use with multiple intervals and/or external symbols. User defined parameters include the type of average, length, symbol, interval and divisor (for volume adjustment).

eSignal version 7.9 is required to run this efs.

Copy [or updated version] of the efs is also available here

Alex

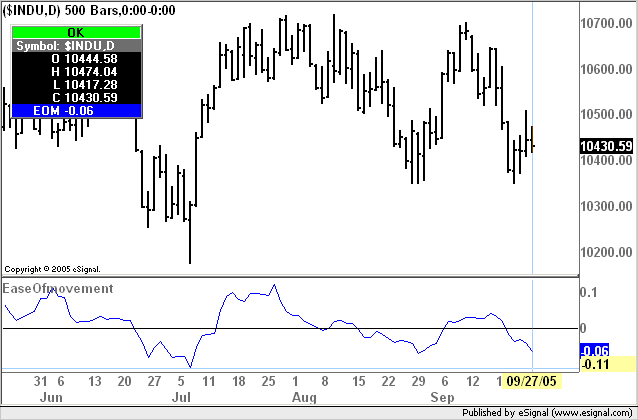

The attached efs computes the Arms Ease of Movement indicator using EFS2 syntax and is enabled for use with multiple intervals and/or external symbols. User defined parameters include the type of average, length, symbol, interval and divisor (for volume adjustment).

eSignal version 7.9 is required to run this efs.

Copy [or updated version] of the efs is also available here

Alex

Comment