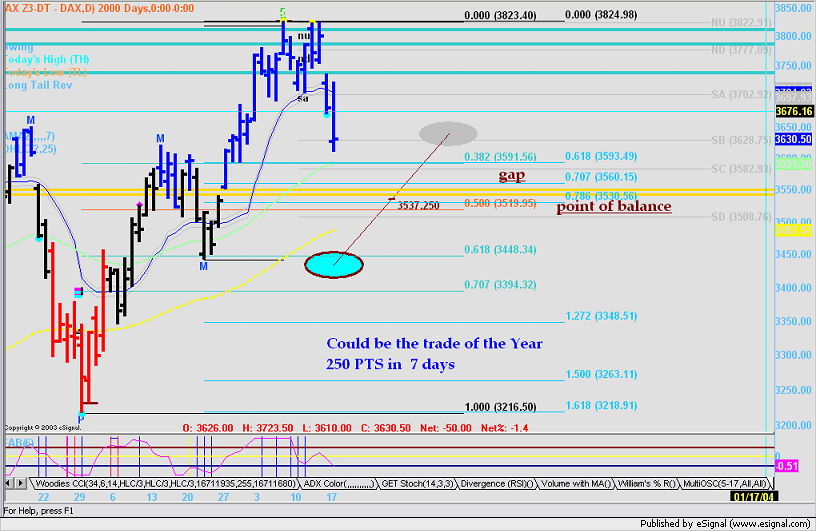

The DAX is very important to look at as well. The markets around the world are all connected in this day and time of 2003. In fact it's my contention that the Kwave rotates around the world and is the reason the US will not have the Prechter depression. Europe was hit in the 1860's, then the US in the 1930's and now Japan in the 1990"s, it rotates around the world.The DAX doesn't seem very liquid, do you swing trade it?

Originally posted by fabrizio

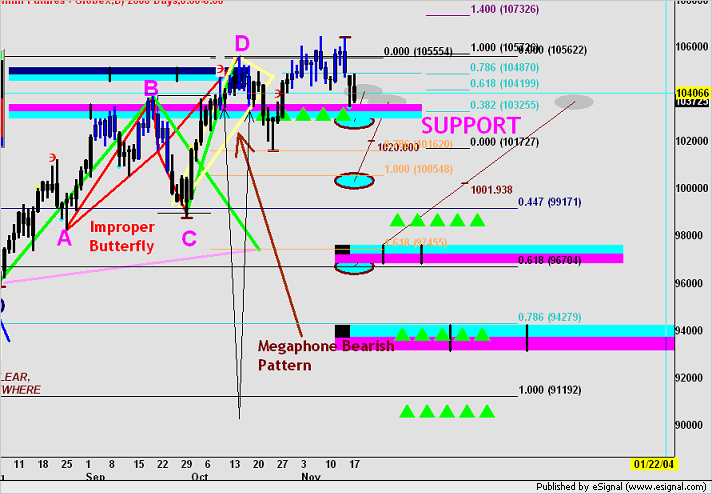

Apologize for posting on Dax, But is just a confirmation of what charted on the previous posts.

http://share.esignal.com/ContentRoot...apshot-107.png

Apologize for posting on Dax, But is just a confirmation of what charted on the previous posts.

http://share.esignal.com/ContentRoot...apshot-107.png

Comment