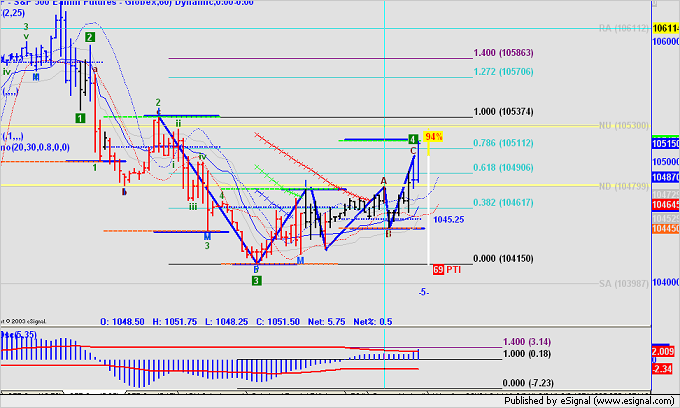

You seem to have alot of conviction Fab, I like that. BUT, Wednesday's S&P I believe will be positive. This has to do with some of the sqrt progressions working with 5 minute charts (and other small time frames). The chart may be hard to read but it's basically starting with the low Oct 24 and counting 5 minute bars using the algorithm of 360 * square roots. So the first one is 509 for sqrt 2 and etc. It's been a nice addition to my other tools. I have been using it to find a pattern and have found that when my cycle time is used as the start and the progression hits 7 or 9 a trend change happens. Of course this is a small trend change because I'm using 5 minute bars but the last one was a good squeeze of 10 points.

Announcement

Collapse

No announcement yet.

Fibo & Geometry

Collapse

X

-

A little bit more of why I'm long at this very moment is this 7 minute chart using the harmonic number 240 (think units in a circle) and sqrt's to 9. The chart shows the small cycle bottom on Oct 24 and the first progression hits the high Nov 3. 240*sqrt 2 is 339. I should have said at first that the trend change numbers I'm using is 7 or 9 and 7 hit early Nov 11 and I bought 10 contracts and went long.Last edited by theplumber; 11-12-2003, 05:45 AM.

Comment

-

Chris

Excellent suggetsion: site very good.

Your Cycle and Hrmics works and I wish you the best (you know that 4, 7, 9,11, 13 , 17 and going aheahd are among my best friends (7 expecially after reading you) : despite that I'm ES short ON since yesterday.

IMHO it dipends by how many poinyts you go for hunting.

If few you are perfectly right to push on size. Today maybe a 56 will be hit.

Took losses on DAX because the narrow range of ES yesterday let him close the damm gap down. However it opened in Gap down today again despite the fact that night session ES was +0.17%

An that means something bearish to me .

I keep my shorts on their way whilst making some "barrels" with my dax appaloosa in the morning....Last edited by fabrizio; 11-12-2003, 05:52 AM.Fabrizio L. Jorio Fili

Comment

-

Not really Ciro

Is a site on the net Commitment of traders (COT) and others indicators . It is of the outmost importance since it help me define the market sentiment of Commercials.

If you really like to make a major step ahead in Astro follow Plumber's indication and buy supertiming by Walker.

There is no cheap book that are really valuables so consider it an investment. But you ought to go side by side with Mr. W.D. Gann theories for it is 150 % coupled with Mr. Gann timing & Cycles.

I personally bought itFabrizio L. Jorio Fili

Comment

-

Another interesting site/service for Gann astro workings is this site. He says he will explain how he does his work in future newsletters.

http://www.rosecast.com/

Comment

-

Chris

First you were right and I wrong . If its 1053 the trend change and your long starts to pump at least up to 57-58 (1.272 and 1.40 fibo retracements)

I got two stops , but small things. .

The other scenario is a good reversal all the way down to tuesday 41.....and maybe further to 39 and 32. We seee it in couple of hrs. But IMHO I more bullish now than down, for the broken 50

Fabrizio L. Jorio Fili

Fabrizio L. Jorio Fili

Comment

-

I'm not trying to be right or wrong, just telling you my analysis of what I see. I went long @1044 Tuesday and have exited @1053 a few seconds ago. You honored your stops, that's great. You live to fight another day. If 1061 is broken in a few days 1093 is a sure bet by 11/26. Watch out for this last sqrt hit this afternoon, it may be a reversal or acceleration point.

Comment

-

This is why I took a chance and bought 1044, look at the chart that goes with this quote. I'm confused in the short term so I always go back to the So9, but when this is my last tool I keep a tight stop.

Originally posted by theplumber

When ever I'm confused I always go back to the trusty Square of 9

Comment

-

If the PPI number is low there could be a small blow off top Friday. The astro is interesting and the numbers project to 1064. May not seem like much but enough to watch dancing bears.Last edited by theplumber; 11-13-2003, 06:55 PM.

Comment

-

I like the color coded astrolog better. If you have Myle Wilson Walkers Supertiming book today was one of his small cycle dates, but not a Supertiming date. Look at the disc he sent to see what I mean, or look at the color coded paper calender and find Nov 14 and see 07 S&P , 22 S&P. The 7 and 22 are codes for the disc numbers to reference. I got the small blow off top and hit my target of 1064, but that was suppose to happen last week. Now S&P should get a good decline to set up the next move higher into the Dec 11 time frame. If this next dip isn't too bad then 1093 is the next stop Dec 11, which is also a Supertiming date.

Comment

Comment